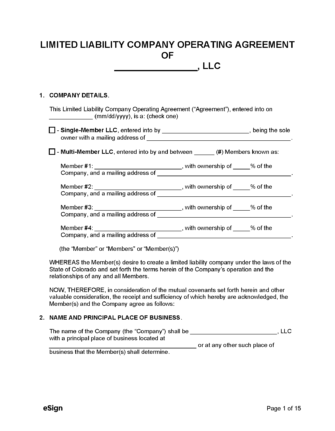

A Colorado LLC operating agreement is a contract in which a limited liability company defines its structure (single-member or multi-member), internal business policies, and ownership. Drafting an operating agreement is critical in identifying the role of each member, including their financial contributions, responsibilities, and decision-making rights. It also helps protect the members from personal liability in the event the LLC incurs debts or gets sued.

Drafting an operating agreement is optional for Colorado LLCs. Nonetheless, the paperwork serves as formal documentation of the company’s rules and regulations and should be executed immediately after the business has been formed.

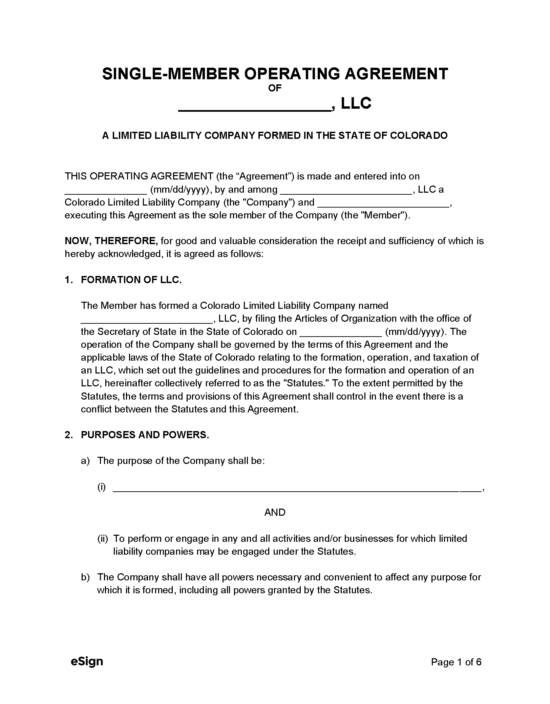

Single-Member LLC Operating Agreement – Establishes the operating procedures of an LLC with only one (1) owner.

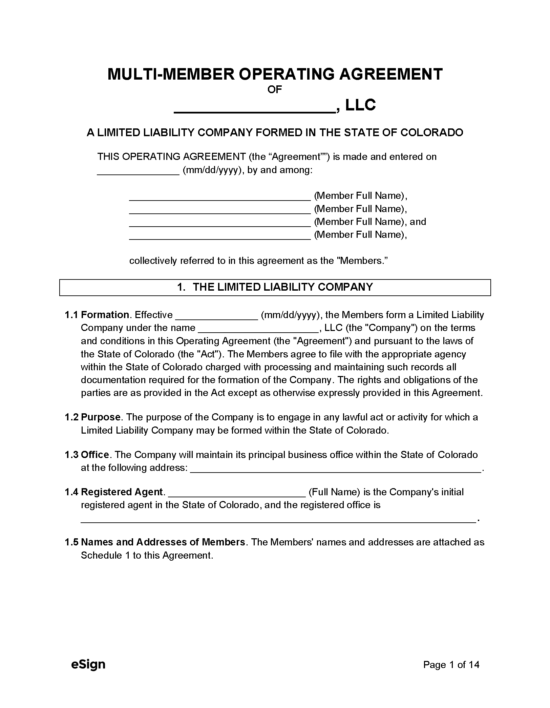

Multi-Member Operating Agreement – This operating agreement should be used when the company is owned by more than one (1) individual.

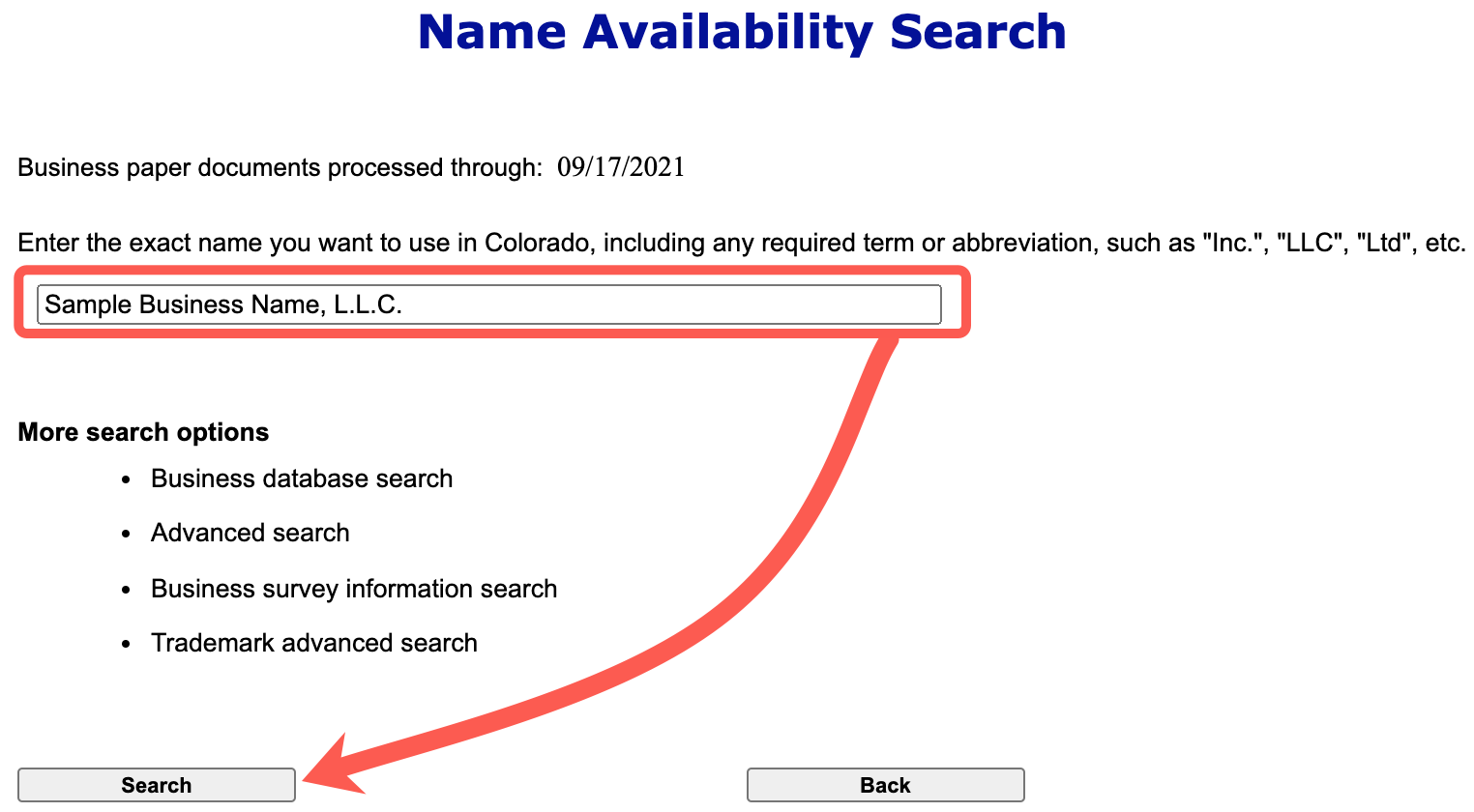

The first step in forming an LLC is to choose a name for the company that isn’t already in use by another Colorado business. Use the Secretary of State’s Name Availability Search to check the availability of the proposed name.

Business names can be reserved for one hundred and twenty (120) days by filing a Statement of Name Reservation (enter the proposed entity name, complete the application, and pay the $25 reservation fee).

An LLC must have a unique business name that is distinguishable on the records of the Secretary of State. Another important note is that an LLC’s name must include the words “limited liability company” or another term or abbreviation authorized in § 7-90-601(3)(c).

A registered agent is an individual or entity that represents the LLC as an official correspondent, receiving service of process and other legal paperwork on the company’s behalf. Each LLC must appoint a registered agent before filing for formation. A registered agent must meet the following requirements:

Individuals

Entities

The registered agent can be any individual in the company or even the LLC itself, so long as the agent meets the criteria listed above.

Filing the Articles of Organization is necessary to register the LLC with the Colorado Secretary of State. The filing process varies depending on whether the company is a domestic entity (formed in Colorado) or a foreign entity (pre-existing LLC formed outside of Colorado).

Domestic

Foreign

It is not a legal requirement for Colorado LLCs to draft an operating agreement. However, having one in place is highly recommended due to the numerous benefits it provides to the company and its members.

An Employer Identification Number (EIN) is a unique code assigned to business entities by the IRS. If the LLC plans to apply for business licenses, open up company bank accounts, or if the LLC has multiple members, it will need to apply for an EIN.

There are several ways to obtain an EIN (see IRS guide), although applying online is the most efficient application method.

Limited liability companies must file a periodic report to maintain a good standing with the Secretary of State. The reports are submitted online and will require the filer to pay a $10 fee.

Periodic reports are due on the anniversary month of the LLC’s formation but may also be filed up to two (2) months before the anniversary month or two (2) months after.

Costs:

Forms:

Links: